If you own a home, Indiana law allows you to protect a portion of the equity in that home. A liquidation analysis determines what would be available for creditors after you deduct the cost of sale and other expenses.

We recently discussed several aspects of bankruptcy with Christopher Holmes and Jess M. Smith, III, partners at Tom Scott & Associates, P.C. The discussion covered several topics, including being “judgment proof,” protecting your house from liquidation in a bankruptcy, home equity exemptions, some benefits of filing a Chapter 13 “100% plan,” common reasons people file for bankruptcy, a deficiency balance on a debt, an example of how an ex-spouse can impact a bankruptcy, and conduit mortgage payments. Below is Part 1 of 2 of the transcript of that conversation.

Q: In regard to a person’s financial situation, what does it mean to be “judgment proof?”

Chris Holmes: Some people have too much debt and maybe they’re on Social Security or they have no income. Those individuals are what we call “judgment proof” because creditors can’t make them pay if they don’t have wages to garnish. A person’s take-home pay must exceed $217.50 per week before they can be garnished. In addition, some sources of income, like Social Security and veteran’s benefits, are exempt—off-limits—from garnishment. If those individuals don’t have any real estate or they have less than $10,250 in tangible personal property, there’s nothing a creditor can take from them to liquidate, to pay on the debt. Sometimes I tell people that they don’t even need me, if they have a strong enough stomach to withstand the calls, the letters, and being dragged into court periodically.

Jess Smith, III: On the other hand, I had a woman come in to see me recently and she hardly has any income, but her name is on the deed of an ex-boyfriend’s piece of lien-free real estate that is worth $90,000. Therefore, she had to pay 100% of her debts to protect that property. She said, “Well, I better go out and find a job first.” She was behind on her residence and thought she could get rid of her other debt and just keep her residence, but she found out her name is on this other piece of property.

CH: Sometimes people come to us, creditors are hounding them, and they don’t have the ability to pay them back. Most people would prefer to file a Chapter 7 bankruptcy and just wipe the slate clean, but we have to evaluate their home and compare it to what’s owed on it. If you own a house in your name only, Indiana law allows you to protect $19,300 of equity in that home. So let’s say you have an $80,000 house and you only owe $30,000 on it, so there’s $50,000 of equity. You can only protect $19,300, which leaves just under $30,700 of non-exempt equity. In a Chapter 7 bankruptcy, the trustee has the power to take that house, sell that house, pay the commission for the sale, give you your $19,300 equitable interest that’s protected, and use what’s left over to pay back some of your debt.

Q: So how do you avoid that?

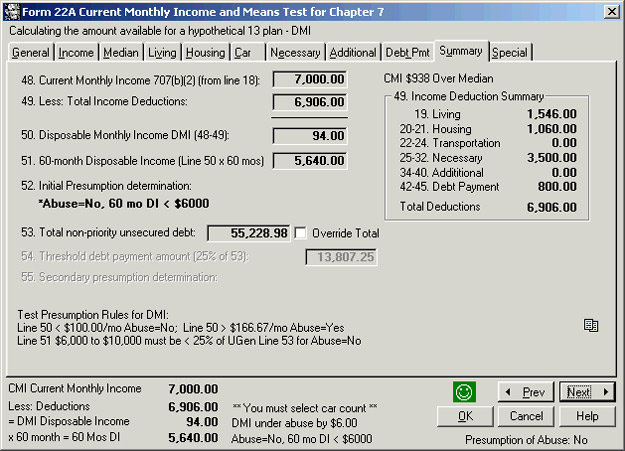

CH: For those people, if they want to protect their house, I ask them if they have a rich relative or a retirement account or some resources to tap. We do what’s called a liquidation analysis to determine what would really be leftover for the creditors once you factor in the cost of sale and some other things. I had a case where a woman couldn’t afford to come up with money herself, but she had a rich uncle who stepped in and gave her a sum of money equivalent to what the trustee wanted to prevent him from taking and selling her house. Otherwise, what most people have to do is file a Chapter 13 bankruptcy plan to pay back to their creditors, over a three- to five-year period, as much or more money than they would have received had the house been taken and liquidated.

Q: Are they paying the full amount of the equity or a certain percentage on the dollar?

CH: What we can do is factor in not only the mortgage and the exemption, along with the cost of sale. We figure out how much would the trustee in a Chapter 7 have received for doing all of that work and liquidating—the trustee gets a percentage of every dollar they collect for the creditors—so we can subtract that amount out. What’s left over is a reduced amount that has to be paid or distributed amongst all of the creditors during that three- to five-year period.

Q: Are those all of the factors that go into the liquidation assessment?

CH: Sometimes there are some other things, like certain taxes that have to be paid first in a Chapter 7, so we factor that in, which reduces the amount even further that somebody would have to pay to protect their home from liquidation.

Q: In a general sense, would you say it’s better to file for Chapter 13 bankruptcy and keep your house rather than to file a Chapter 7 and lose your house?

CH: It depends on the debtor. Maybe they don’t even care. They might live in a terrible neighborhood and don’t like their neighbors, or they’re tired of raking the leaves and mowing the grass. It’s rare, but I’ve had a client who said, “Fine. Mr. Trustee, take my house, sell my house, and give me a check for my equity amount.”

Q: Tell me a little more of the specifics about this woman who had her name on the deed of her ex-boyfriend’s house.

JS: Her first issue is that, because she is between jobs, she is behind on the regular mortgage payments for her residence. She owned her own home and had a half-interest on this other house, so she was going to have to file a Chapter 13 to catch up on the overdue payments on her home. Then, when she lost her job, her car got repossessed, because she couldn’t pay for it. I don’t know which came first, the job loss or the repossession, but she just had the car repossessed and she thought she had a citable deficiency of about $15,000. In other words, after the car was repossessed and sold, they’re coming after her for that $15,000. I explained to her that because of the equity she has in the non-residential real estate, she would likely have to pay the deficiency on the car she just lost. So she said, “I understand that and I knew that, so I’ve got to get a job to make this all work.”

Q: Who owns the other half of that non-residential property?

JS: An ex-boyfriend that put her name and his name on the deed about 20 years ago when she had loaned him some money.

Q: So your recommendation to her was to not file for bankruptcy?

JS: Not until she has some cash flow that can fund a Chapter 13.

Q: Why did she want to protect the ex-boyfriend?

JS: I’m not sure, but she was very adamant that he should not lose that real estate because of her.

Q: Could she have taken a different, less-friendly approach regarding that other property?

JS: She could have filed a Chapter 7, but it wouldn’t help her cure the arrearage on her residence. We’ve agreed she’s going to eventually file a Chapter 13.

Q: Would you have to meet the best-interest-of-the-creditors test if she didn’t care if that other property was taken and sold?

JS: Yes, because a Chapter 13 trustee is not going to liquidate it. I have the same issue in another case I have in which a woman is in what’s called a “100% plan.” She has to pay everyone back, because she has $50,000 to $60,000 equity in a residence. In addition to that equity, she was also try to cure the arrears on it, because she had one health issue after another after another. The ongoing mortgage payments were being paid by the trustee, but she wasn’t making enough to do that and pay for the car she wanted to drive. She had visions that she was going to refinance the mortgage outside of the bankruptcy. So, I filed an amended plan that says we surrender our interest in the house, but we now want to pay for the car and pay the balance of the attorney fees, and chop the payment way down from about $1500 a month to $400 a month. I now have an objection from the trustee saying we haven’t met the liquidation test on the equity of the house.

Q: Even though she’s surrendering the house?

JS: We haven’t fought it out yet, but it drew an objection.

Q: What is the objection based on?

JS: Because she could sell her real estate and pay off the mortgage and there would still be money for other creditors creditors. That’s what the trustee said. At least on paper, there’s a ton of equity here. She has a son and his fiancé who’ve said they want to refinance it, but the trustee wants money for the creditors.

Q: For clarification, what exactly is a 100% plan?

JS: Every creditor that files a claim will get paid in full.

CH: So, in that Chapter 7 liquidation, there would have been enough money to pay back every single penny of all of the debt. In a Chapter 13, to prevent the sale of the house, you have to make sure that every single penny of that debt gets paid, to protect the equitable interest in the real estate. The benefit of the Chapter 13 then could be—because I’ve had people ask, “What benefit is it for me to file Chapter 13 bankruptcy if I have to pay back everybody in full?”—first of all, once they’re under the protection of the Chapter 13 bankruptcy creditors can’t call, can’t write, can’t sue, can’t garnish. Also, as soon as we file the case, no more interest can accumulate, no more late charges can be imposed or attorney fees assessed. And, those creditors have a window of opportunity—about four months from the date of the filing of the case—to file what’s called a Proof of Claim. So if somebody wants to get paid, they have to file a claim with the bankruptcy court before what’s called the bankruptcy Bar Date. If they don’t file a claim by that date, they don’t get any money.

Q: So, it puts the onus on the creditors to do something to get paid?

CH: Right. We had an extraordinary Chapter 13 case not too long in which we had a high-income dentist making enough money to pay everyone in-full. The total of her unsecured debt to be paid through the plan was around $106,000. So we came up with a plan payment that over 60 months she would pay every single penny of that debt, without any interest or late charges. But—and it’s the only time I’ve ever seen it happen—not one single creditor filed a claim. So, whereas she would have had to pay the entire $106,000 through this plan, she got out of the plan with a discharge on all $106,000 of debt and didn’t have to pay one penny on any of that debt, because not one of those creditors was on-the-ball enough or smart enough to file a claim.

Q: If there were no payments to be made, did the discharge come immediately?

JS: Actually, after payment of attorney fees and trustee fees; after the claims deadline.

CH: I had a Chapter 7 case in which the trustee decided the debtor had an asset that legally could not be protected, so the trustee wanted to take and liquidate it. The trustee sent out a notice to all of the creditors to file a claim, because there would be money available for them. Not one single creditor filed a claim, so the trustee sent out a second notice that said, “I’m going to have money for you if you file a claim.” Again, not a singular creditor filed a claim, so the trustee had no one for whom to collect some money, so he could not and did not take the property that had been subject to liquidation. The debtor got to keep the property, because for whatever reason, creditors did not file a claim. Those are anomalies, but when you do as many cases as we do, you see more and more of those kinds of unusual situations.

Part 2 of Conversation: Common Reasons People File for Bankruptcy