If you will be filing for bankruptcy protection, you have a few options regarding the best way to pay off a car loan or to buy a new vehicle before or during the period of a Chapter 13 bankruptcy.

Key Points of This Article:

- If your vehicle loan is over two-and-a-half years old and the remaining loan balance is greater than the car or truck’s current value, Chapter 13 could provide an opportunity to lower the remaining loan amount and interest rate, and then pay the loan off as part of your approved bankruptcy plan monthly payment. The amount you ultimately pay for your vehicle could then be significantly less than your current total loan amount—and you would own the car or truck outright when the case is successfully discharged.

- If your vehicle loan is less than two-and-a-half years old and the interest rate is already 5% or less, to keep the car or truck you would need to continue to pay off the loan on your vehicle outside of a bankruptcy plan.

- A sudden need to acquire a new vehicle during an approved bankruptcy plan presents a potential need to submit a request to modify the plan. The trustee of the plan would need to approve that new additional debt as part of your monthly plan payments.

- A bankruptcy plan trustee’s job is to retrieve money for creditors, so they may consider a monthly vehicle loan payment above a certain amount inappropriate as part of a Chapter 13 bankruptcy plan. If you file for bankruptcy, you may need to switch from an expensive luxury vehicle to a model with lower monthly payments.

- In addition to your transportation costs, a Chapter 13 trustee will use established federal standards to determine what they consider as your reasonable monthly “cost of living” expenses, including housing, utilities, food, clothing, and out-of-pocket health care expenses.

We recently discussed some aspects of bankruptcy with Christopher Holmes and Jess M. Smith, III, partners at Tom Scott & Associates, P.C. The discussion covered several topics, including the affect of paying off a car loan during a Chapter 13 bankruptcy, buying a new vehicle before or during a bankruptcy, what is a “cram-down,” modifying a bankruptcy payment plan, and means testing. Below is the transcript of that conversation.

Q: Does the fact that a debtor who is planning on filing for bankruptcy protection is currently making car loan payments, but the loan will be paid off within a year or two, affect the plan you propose to the bankruptcy court?

Chris Holmes: When I meet with clients in that situation, in a Chapter 13 case where the plan life is anywhere from 3 to 5 years, we weigh the pros and the cons of them either paying for the car directly outside the bankruptcy court versus throwing it into the plan and paying for it over the life of the plan. What we’ll look at is how old is the vehicle loan. If a car loan is more than two-and-a-half years old on the day of filing, and if the payoff on that loan exceeds the fair-market value of the vehicle by a significant amount, then we do this thing we call a “cram-down.” We take the higher payoff and reduce it—cram it down—to what the vehicle is worth. The debtor pays that amount, saving all of that extra principal. Often times, these loans have a very high rate of interest, so we can effectively cram that interest rate down, within the plan, from the high rate to the prime rate plus 1.5%.

As an example, if someone owes $20,000 on a car only worth $15,000, and that loan is supposed to be paid at 21% interest, what we say to the car creditor is that we’re only going to pay the value, $15,000, at perhaps 5% interest through the plan, saving the extra principal and extra interest on that loan. That’s a clear win for the debtor.

If the car loan is less than two-and-a-half years old. we can’t cram the payoff down in value. In that situation, the only thing we can do is reduce the interest rate, so a debtor would payoff the loan through the plan at perhaps 5% interest, to save a considerable amount of interest.

If the loan is less than two-and-a-half years old and the interest rate is already 5% or less, there’s no real advantage to paying it off through the plan, so then we would make arrangements for that debtor to continue to pay on that vehicle outside of the bankruptcy court.

If the bankruptcy plan life is 60 months, but the car loan is going to be paid off in, for example, 36 months, that scenario creates a potential problem. Previously, we would tell the trustee that, when the car was paid in full, the car loan payment would be used to purchase a replacement for that car or maybe a second car for the debtors. The trustees used to accept that at face value, but evidently they have recently learned of too many circumstances, after the car loan was paid in full, in which debtors weren’t using that monthly car payment for the purchase of a replacement or second vehicle. Now trustees don’t trust debtors anymore, so we’re compelled to sign agreements whereby the monthly bankruptcy plan payments increase, for the remaining months of the plan, by the amount that was being paid monthly for the car loan.

In those types of cases, we will go back to the bankruptcy court and ask the judge to allow the debtor to renege on that pledge when the debtor presents to the judge a tentative car loan for a replacement or needed second vehicle. We have the burden to go back into court to request permission to modify the plan back to what we intended, so we can use that extra money for the purchase of another vehicle.

Q: What happens to an individual who has (1) already filed bankruptcy, (2) set-up a plan, (3) their income is such that they are just able to take care of their current bills and monthly payment to the trustee, (4) they haven’t had a car payment during the plan, and then (5) all of a sudden their car breaks down beyond repair and they need to buy a replacement vehicle? Can you modify their bankruptcy plan mid-stream to account for their need to take on a new monthly car payment they did not have before the plan started?

CH: That creates another dilemma, because when we filed the case we submitted a budget that showed all of the debtor’s different monthly living expenses. If the debtor doesn’t have any money allocated for a regular monthly car payment at the start of the plan, the trustee will not approve a loan for that car unless we amend their budget to show the debtor now has the money available for the vehicle loan payment.

What we might have to do is go through the other budgetary items to determine if possibly the debtor is no longer paying so much for child care or perhaps their rent went down. We try to find cuts in their budget. Sometimes, if we don’t find cuts in their monthly budget that equal the amount of the proposed monthly vehicle loan payment, we’ll look at their paycheck to see if they’ve received a cost-of-living adjustment or maybe the withholding for medical insurance has gone down a little bit.

Between a little more disposable monthly income and a few less monthly expenses we night find the extra income needed to pay for the car loan. We’ll then put that amount in an amended budget, submit that to the court along with a copy to the trustee. Then, when the debtor goes to the trustee for permission to the car, the trustee can look at the amended schedule, see that the necessary funds are available each month to pay for the vehicle, and approve the loan.

Q: Would it be in the best interest of someone who was planning on filing for bankruptcy to buy a new car or reliable used car before filing.

Jess Smith III: The bankruptcy code states that we cannot counsel a client to incur new debt on the eve of bankruptcy.

Q: What period of time constitutes “the eve of bankruptcy?” In other words, how much time does someone need to wait between buying a new vehicle and filing for bankruptcy?

CH: I don’t advise clients about that type of activity. What I tell people is that I’ll put $350 in the monthly budget, even though they’re not currently spending that for a car loan, but that they’ll have to go out immediately after filing the case and start shopping around for a vehicle. If the trustee doesn’t receive that request he or she is going to want that $350 each month to give to the creditors.

JS: I told a client to dump his big fancy truck and its $750-a-month payment, which the trustee would think is excessive, and to go get a $350-per-month replacement. The trustee is now demanding proof of that $350 monthly payment, otherwise he is going to want that money for the creditors. We recently met with the creditors, who asked if my client had bought the replacement truck yet. The client said, “No, I need to save my previous monthly payments to accumulate enough money for a down-payment on a replacement.” The creditors stated that unless he does that by the claim bar date, they’re going to ask for that money to go into the plan.

CH: The trustee’s job is to squeeze as much money out of a debtor as possible for the benefit of the creditors. That’s why they look at projected income and projected expenses. Sometimes they will scrutinize the budget and find there’s some “fat” in it. Maybe we put too much money in there for food or clothes or some other expense—and the trustee will say that’s excessive. We then have to reduce that number to free up some money for the plan payment, which will increase by the amount of “fat” we cut out.

Q: Is there a schedule or chart published by the State of Indiana that shows the average household expenses for a single person, a married couple, and families of different sizes?

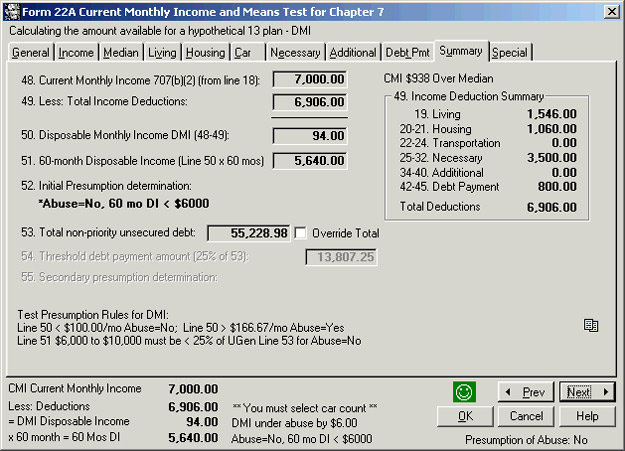

JS: There are federal standards (Dept. of Justice Means Testing) that are loosely based on if the IRS is considering going into an installment arrangement with you to pay federal taxes. The IRS publishes amounts they consider to be reasonable for the cost of housing, utilities, transportation, food, clothing, and out-of-pocket health care expenses. The trustees have adopted those figures, but on occasion they’ll take a harder line on a case-by-case basis.

CH: The computer program we use to determine a client’s budget has those regular monthly living expenses built right into it.

Q: Is the IRS standard different for each state?

JS: There are housing allowances listed for each county in every state. For median incomes, the allowances are listed state-by-state, and there are national allowances for food, clothing, transportation, etc.